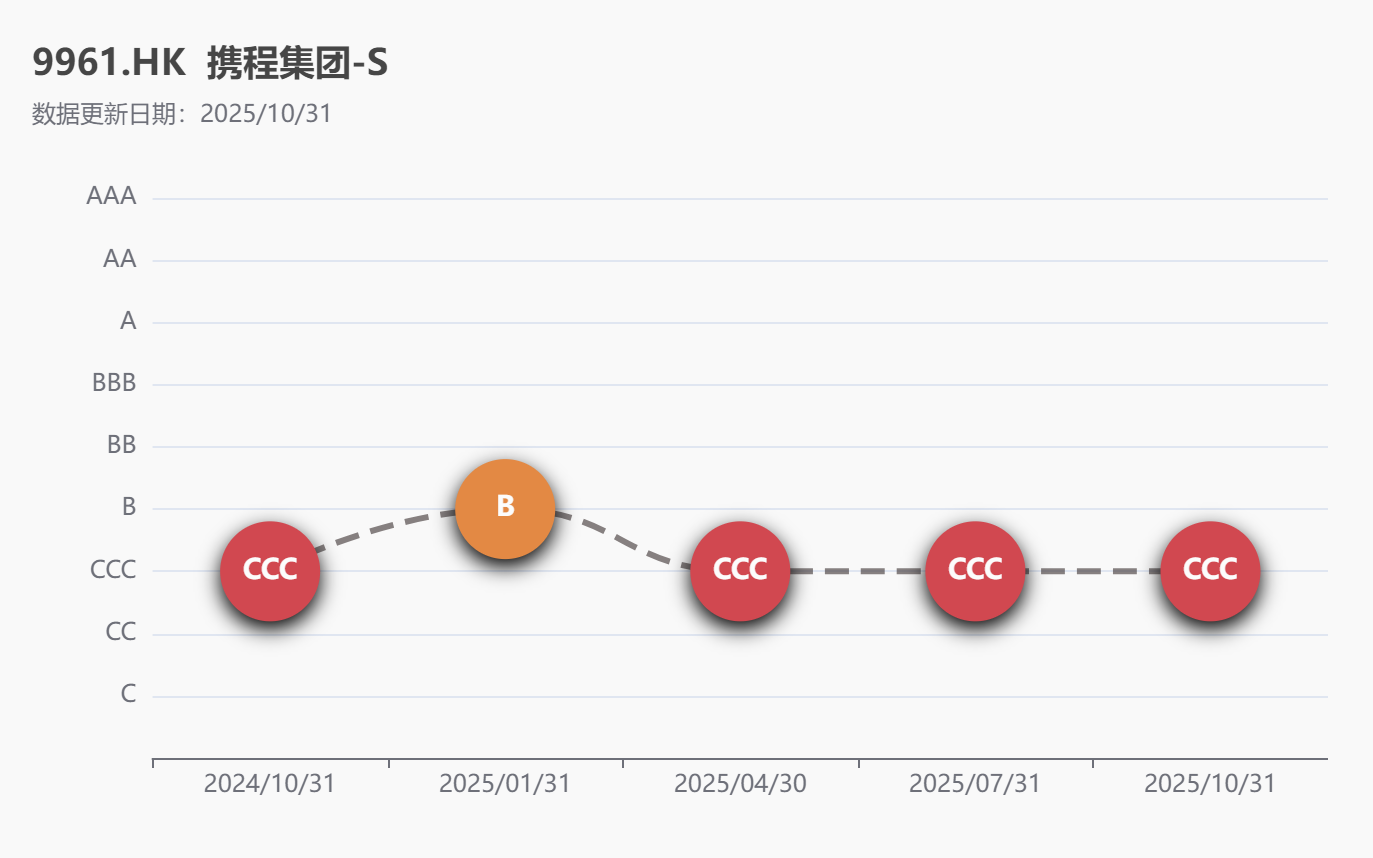

In the latest ESG rating results (October 31, 2025) released by China Securities Index, Trip.com Group (09961.HK) continued to maintain a CCC rating, ranking 45/63 in the GICS Level 3 industry "Hotels, Restaurants & Leisure," with its overall ESG performance positioned in the middle to lower tier of the overall market.

Trip.com has been disclosing ESG reports for six consecutive years. According to its "2024 Sustainability Report" released in July 2025 (covering both Ctrip and Trip.com brands), the report systematically discloses the phased progress of Trip.com Group across various areas, centered around the four sustainability strategies of "Industry-Friendly, Community-Friendly, Family-Friendly, and Environment-Friendly."

Image source: Trip.com Group 2024 Sustainability Report

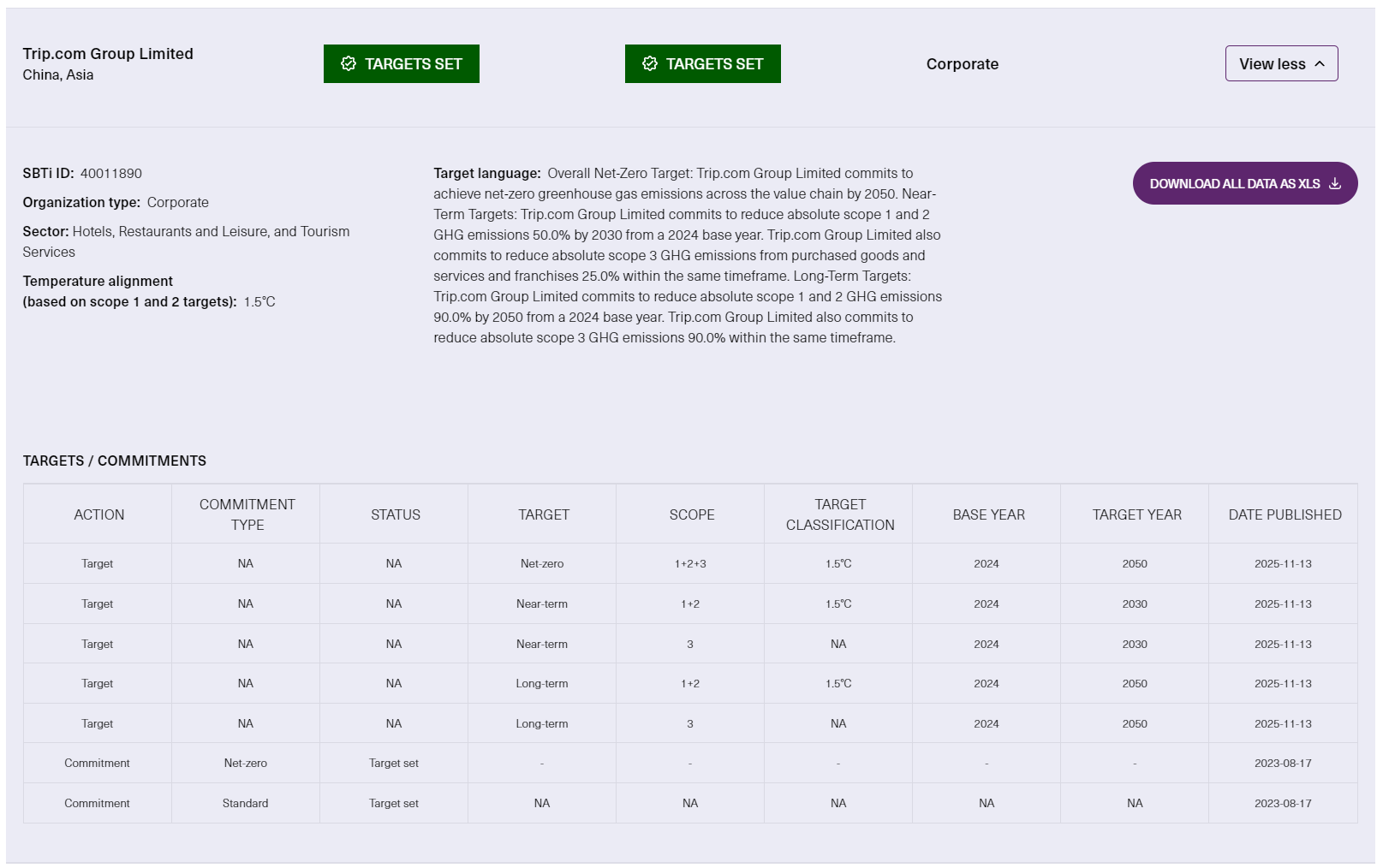

Regarding Environment-Friendly, Trip.com has begun accounting for and disclosing Scope 3 emissions data. A key development is that in November 2025, Trip.com Group announced that its greenhouse gas emission reduction targets had been officially validated by the international authoritative body, the Science Based Targets initiative (SBTi), making it the first online travel company in the Asia-Pacific region to have both its near-term and net-zero targets validated by SBTi.

Within the "Industry-Friendly" strategy, Trip.com commits to: adhering to compliant operations, protecting user privacy and data security, enhancing travel experiences through innovative products, and assisting industry partners and tourist destinations in their development. It actively expands the inbound tourism market, promotes the prosperity of cultural tourism economies, and builds a sustainable tourism ecosystem for mutual benefit among users, partners, and society.

However, controversies surrounding consumer rights protection and platform rule transparency continue to pressure Trip.com's performance in the social and governance dimensions. On consumer complaint platforms, Trip.com has been frequently criticized for issues such as opaque ticket refund and change rules, hotel booking disputes, suspected "dynamic pricing" (or "big data-based price discrimination"), and bundled sales. On the other hand, Trip.com has been accused of unreasonably interfering with merchants' pricing power on its platform through the "Price Adjustment Assistant" tool, and of requiring partner hotels and homestays to implement "pick one out of two" practices to exclude other competing platforms. These longstanding pain points for users and merchants clearly contradict its advocated vision of a "Perfect Journey" and a mutually beneficial ecosystem.

On January 14, based on prior investigations, the State Administration for Market Regulation (SAMR) initiated an antitrust investigation into Trip.com Group Limited for suspected abuse of market dominance, in accordance with the "Anti-Monopoly Law of the People's Republic of China." Although Trip.com promptly responded that the company would actively cooperate with the investigation and its business operations remained normal, affected by this event, the U.S.-listed Trip.com Group (TCOM) fell 17.05% on January 14, and the Hong Kong-listed Trip.com Group-S (09961) fell 19.23% on January 15.

This investigation is not a sudden development but rather the inevitable result of accumulated long-term governance risks. In August 2025, the Guizhou Provincial Market Supervision Administration collectively interviewed five online travel platform companies, including Trip.com and Tongcheng Travel, requiring them to strictly comply with laws and regulations such as the "Price Law of the People's Republic of China," the "Anti-Monopoly Law of the People's Republic of China," and the "Regulations on Clearly Marked Prices and Prohibition of Price Fraud." The authorities demanded these firms resolutely curb price disorder and maintain a fair, orderly, and trustworthy market environment. During the interviews, regulators issued risk warnings regarding potential issues like "pick one out of two" practices, using technical means to interfere with merchant pricing, breach of contract or price hikes after order confirmation, price fraud, and price gouging. They required the relevant platforms to earnestly fulfill their primary responsibilities, immediately conduct comprehensive self-inspections and corrections, and continuously strengthen compliance and self-discipline.

As a leading global one-stop travel service provider, Trip.com offers comprehensive travel solutions covering accommodation booking, transportation ticketing, tour packages, and business travel management. Its portfolio includes major online travel agencies (OTAs) such as Ctrip, Trip.com, and Qunar, as well as the search platform Skyscanner. According to estimates by Bank of Communications International, based on 2024 GMV, the Trip.com ecosystem holds nearly a 70% market share.

According to Article 57 of the "Anti-Monopoly Law of the People's Republic of China," if an operator abuses its market dominance, the anti-monopoly enforcement agency may order it to cease the illegal acts, confiscate illegal gains, and impose a fine ranging from 1% to 10% of its sales revenue from the previous year. Financial reports show that Trip.com's total revenue for 2024 was RMB 53.377 billion (+19.8%), and its total revenue for the first three quarters of 2025 reached RMB 47.081 billion. J.P. Morgan pointed out in a research note that any potential fine may be calculated based on the 2025 operating revenue, estimating Trip.com's 2025 revenue at approximately RMB 61.9 billion, with the fine potentially ranging between RMB 0.6 billion and RMB 6.2 billion.

Beyond antitrust risks, it is noteworthy that Trip.com has also recently faced user concerns regarding data security and platform trust related to its cooperation with the Cambodia National Tourism Board. In September 2025, Trip.com signed a marketing cooperation agreement with the Cambodia National Tourism Board, planning to launch advertising content after Cambodia's visa-free policy for Chinese citizens took effect. Faced with public opinion pressure, Trip.com issued a statement on December 25, 2025, stating that "the cooperation has not been initiated, the agreement does not involve any data cooperation, and there is absolutely no situation involving the disclosure of user private information." Nevertheless, this statement has not fully dispelled public doubts.

Author:Qinger